Will Crypto Mining be Profitable in 2018?

Crypto mining, including bitcoin mining, ethereum mining, ASIC mining, and GPU mining has continued to be a very popular topic for people interested in side hustles and entrepreneurial ventures. One of my most popular 2017 articles was “Is Crypto Mining a Profitable Side Hustle?” which evaluated whether or not was effective, profitable side hustle and passive income stream.

When I started, back in early 2017, I had a lot of skepticism about the long-term potential, but fortunately my dabbling has paid off tremendously. And it has satisfied my inner geek.

Ethereum mining has been my major focus, so this post will come primarily from that frame of reference.

And this will give away my slant…but let me just say that I have continued to cautiously buy mining gear over the course of 2017 and still into the start of 2018.

What has changed in crypto mining since 2017?

In my original post “Is Crypto Mining a Profitable Side Hustle?” I discuss the details of a few factors that have the potential to derail mining profitability. Those include:

- Network difficulty increases: supply and demand of mining and planned reductions in mining effectiveness

- Price changes: if price of the currency drops, your profitability drops

- Proof of Stake: Ethereum and other coins will eventually switch to a model that does not require mining in its current state

See a deeper dive of these risks in my post here: What are the risks of mining Ethereum?

So how have these concerns held up?

- First, there have indeed been network difficulty increases (see this chart).

- However, that difficulty has been offset by the massive price increases of Ethereum.

- Last, although Proof of Stake will eventually hit, there are many…many…other coins to mine, and the date for PoS is still unclear. Once this happens, there will be a dilution of profitability as miners move to other coins and sell their gear, but I’m not worried about it…as long as I hit ROI quickly (more on this below).

Fundamentally, there have been ups and downs, but mining is just as profitable today as it was nearly 7 months ago. Nearly everyone cautioned otherwise, but most people didn’t expect the massive run up in price either.

That’s an 11,895% increase in price. Holy sh#t.

By the way, I was screaming excited back in May when it was a mere 295% increase.

Should I mine, trade, and/or buy-and-hold crypto?

Ah, the money question. Shouldn’t I just buy crypto? Wouldn’t I make more money than if I mined?

This is an important question and has a lot to do with another passion of mine…real estate investing.

- Buying a crypto is a speculative asset play. To realize a gain, the value of that cryptocurrency must go up.

- Mining crypto is a cash flow play. To realize gain, you need to be able to sustain profitable operations. Additionally, if you hold your output, the value of the retained asset can go up.

Buy and hold (HODL)

In the case of 2017, you would have been better off buying crypto than buying mining gear in almost every scenario. That is because of the massive run ups in price…and things could have very well gone the other way.

I am a big fan of HODL and this makes up the main part of my crypto strategy. Here’s my Tesla’s license plate:

By the way, if you don’t know the drunken-rant backstory on the term HODL, you can read about it here.

Mining

Mining has a few unique benefits:

- It takes the guess work out. With volatile price changes, it’s hard to know when to buy. Mining gives you a consistent dollar-cost-average mechanism…constantly buying you into the markets.

- It keeps working indefinitely. While a buy-and-hold may beat out mining in a few months or year span, mining should eventually overtake.

- Regardless of the financials, mining is cool…if you’re a geek. Jokes aside, it can be a fun hobby and very interesting for certain people. Will it scratch your intellectual itch?

Another question you’ll need to ask yourself is will you be pulling your mined crypto out on a monthly basis and taking the profit in fiat (like US Dollars)? Or will you be leaving it in crypto so that you are building your portfolio. Both are options.

Trading

The last option is to actively trade crypto. When you do this, you’re moving in and out of currencies hoping to capture short-term gains by timing the market. This is insanely risky.

My main advice here is to watch for bad advice from charlatans. When a market goes up nearly 12,000%, it’s easy for ANYONE to be a “good” investor. Will those people do well if the market changes? Will their strategies hold up if they invested in other markets? Be careful.

The right mix of crypto strategies

Ultimately, I prefer a mixed strategy. I think of it as a percentage game. My portfolio looks roughly like:

- Buy-and-hold (HODL): 80%

- Mining (GPU): 15%

- Trading: 5%

And as I put in my original post, I would only invest money you’re willing to lose. The crypto markets are insane. Many currencies were trading around one dollar not too long ago…and there’s always the potential they’ll drop right back down.

How much money do I need to mine crypto?

This is a business question! You need to evaluate your miner purchasing decisions based on numbers. The simplest way to do this is to look at current day profitability using a site like https://whattomine.com/

That site is a lifesaver! You can plug in the GPUs you’ll be using and see up-to-the-minute stats on earnings potential.

Based on this, you can figure out how much money you’re willing to spend to buy those earnings. This is just like any business. You’re investing in the cash flow, assets, and future potential.

The more stable a business, the longer the ROI (return on investment) you’ll accept. For real estate investments (rental properties), I’ll accept a 3-4 year break even.

Mining, however, is much less easy to predict, so I want a much fast break-even point. Ideally, I can get my money invested back in 2-3 months.

Looking at whattomine right now, a rig with 6 RX 570s would net me $750 per month. So I’d want to build a 6-GPU rig for $2000 or less in order to hit my ROI target. With some careful purchasing, that’s doable.

But watch out, you can easily spend $5,000 building a 6-GPU rig. Figure out your numbers and go from there.

>> If you want help analyzing a business, check out my free course which includes a business analysis tool.

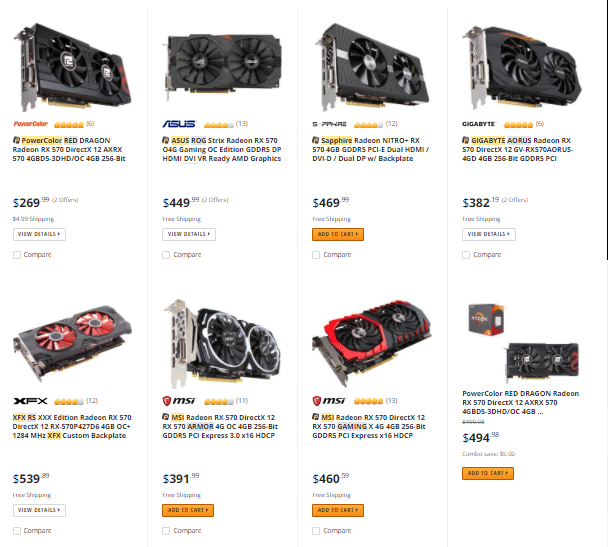

And let me show you what I mean with prices…looking on Newegg the other day, you can find cards ranging from $269 to $539. Be patient. Did I say that before?

Should I GPU mine or ASIC mine?

If you haven’t already, make sure to get with some friends and set up your own crypto “master mind” group.

I mention this, because I have a lot of miners in my circle of friends. The benefit is I get to watch a wide variety of results and build my experience by proxy. Based on this, I have some recommendations.

ASIC Miners

ASIC miners are specialized pieces of equipment that are optimized for a particular coin (or in reality, a hashing algorithm). These are boxes you plug in, do some minor configuration, and then let them run. They are effectively plug-and-play. But they aren’t designed to do anything apart from mine that particular algorithm.

Head over to whattomine and click on the ASIC tab to see the coins you can mine.

The big problem with ASIC miners is suppliers can flood the market with them. This increases the supply of miners and can massively reduce the earnings. Worse, a company could come out with a new device that mines 1,000x more efficiently and it would render everyone’s devices worthless. The Antminer D3 was a great example of this. It was advertised as having insane profitability. But once they were released, they flooded the market, overwhelmed demand, and profitability tanked. These devices mined the X11 algorithm, which is used by few coins.

ASIC miners are also largely controlled by a single Chinese manufacturer.

From everything I’ve seen, you need to get in very early on any new ASIC release, otherwise you’ll end up holding the bag. There are a few exceptions, but I personally see ASIC miners as very risky for the average person.

GPU Miners

GPU miners tackle a different set of algorithms that are intentionally ASIC resistant. Instead, you are using standard computer parts, namely graphics cards to do the mining work.

New graphics cards don’t necessarily translate to better mining. In fact, one of the best GPUs for mining is the Radeon RX 470, which was released in 2016. Two generations of Radeon cards forward, you’ll find the Vega series which currently doesn’t come close to matching return on investment.

GPUs are easy to model from a numbers perspective. Head over to whattomine and look at the GPU tab. Here, you just plug in the type and quantity of cards you’re going to use and you’ll get your profitability. Nice.

Plus, the cards you buy have other utility. If you stop mining, you can sell the cards or just have a killer gaming machine.

What are the risks of crypto mining?

The risks of crypto mining have not changed since 2017. You can find full detail in my article here: What are the risk of Ethereum mining?

At a high level, they remain:

- Price of the coin you’re mining can drop, suppressing the entire market and resale price of your gear.

- Difficulty can increase to as unacceptable point.

- Proof of Stake will hit and profitability across other coins will drop as miners flood them.

To give you perspective on difficulty, my original post was in May of 2017. Price has gone up about 6x since then and profitability has stayed about constant. Had prices not gone up, profitability would have shrunk potentially by 6x (though you may have had fewer miners diluting the network).

How do I find equipment to mine crypto with?

Much like any business, you need to shop smartly! Don’t rush.

When I buy a real estate investment, I don’t buy just any house. I wait very patiently until I find a good deal that meets my cash flow targets.

The same goes for buying mining gear. This stuff is in short supply. You need to buy carefully and wait for deals. If you don’t, you’ll end up spending 2-10 times more than you need and your ROI will be pushed out dramatically.

I just go this shipment of RX 570s:

This means you need to scour the internet and potentially local stores. I’ve purchased cards from Ebay, Newegg, Amazon, and Best Buy (in store!). Know your numbers, don’t rush, and you’ll steadily build up a profitable operation.

Also, if you are seeing a crunch on video cards, you may only be able to order one at a time. Typically that means you just need to wait 48 hours between orders.

Personally, I’ve found the best deals on the RX 570 series of cards.

As for other equipment, you shouldn’t have any issues finding parts. Here’s a good guide on Reddit for the rest of the mining hardware you need.

What coins should I mine?

You might think you should just head over to whattomine and pick the highest coin on the list. Here’s the thing though, coins with smaller market caps tend to be very volatile. They may be highly profitable today and a total loser tomorrow. Sticking with the bigger coins delivers a more consistent result.

You can also dual mine, which means you run to complimentary algorithms at the same time. I’ve had mixed success with this personally. In general, I find my systems to be considerably less stable while dual mining. Eth-only mining gives me near flawless uptime.

Ethereum has been consistently high for AMD cards. Zcash has been great for Nvidia cards.

Additionally, you can mine to Nicehash. This allows you to lease your mining power. Nicehash utilizes your power to mine optimally across numerous coins. You’ll find Nicehash profitability alongside coins on whattomine.

Where can I find information on how to mine?

I spent a lot of time Googling every detail when I first started. Reddit continues to be one of the best resources with the most up-to-date information. This guide is a great starting point: Reddit Ethereum Mining Wiki Index

Conclusion

I enjoy mining and it continues to be very profitable. Mining will maintain its spot in my overall crypto portfolio.

What has your experience been? What questions or tips would you like to share? Let me know in the comments below!

What’s your electricity bill like??

Ha, it’s definitely much higher than ever before. 🙂

For the car, I have a supercharger nearby. For the cards, electricity is part of the calculation on whattomine. You just need to grab one of your electric bills and plug in the $/kWh. It’s pretty minimal.